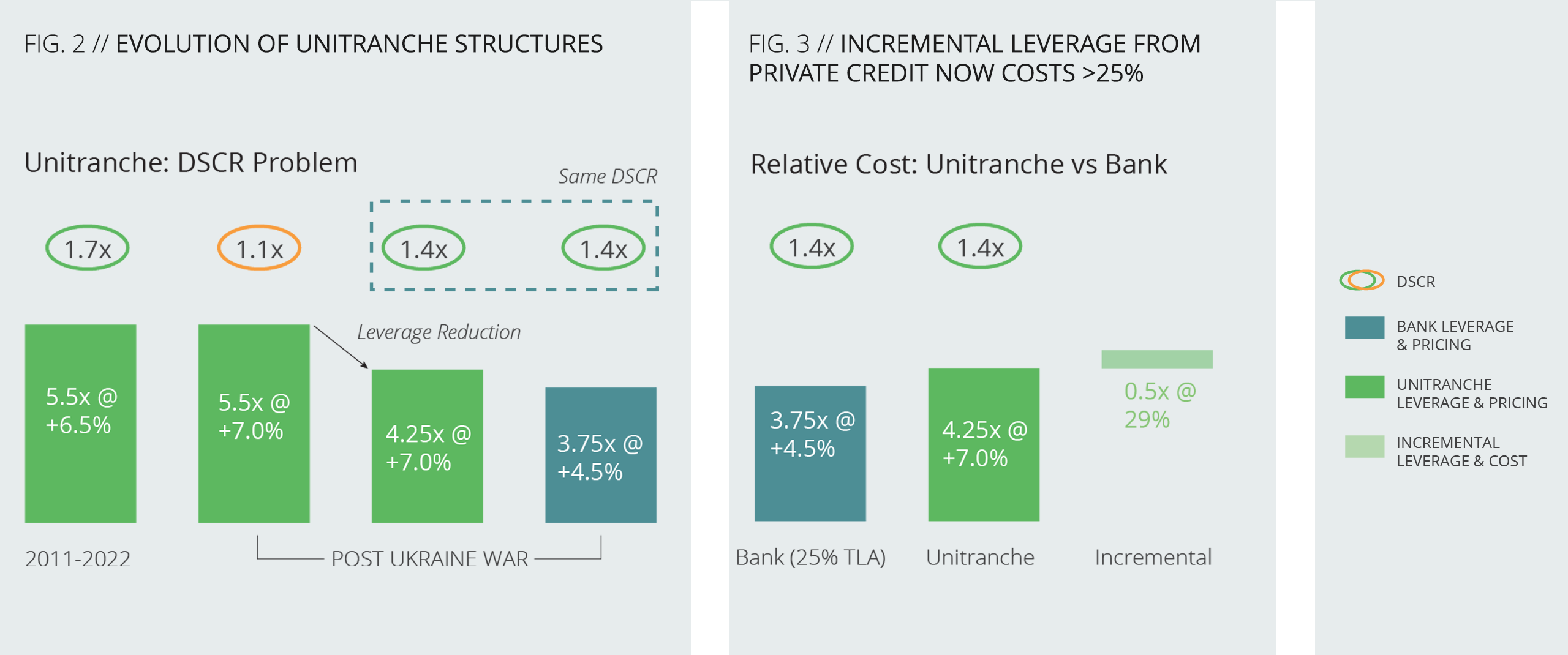

Moving this analysis forward into a higher base rate environment (margins have also increased since the Ukraine war) the same level of debt is not sustainable, as DSCR levels would be at c.1x. In order to compensate for this, unitranche debt levels have had to dramatically reduce.

Bank structures have been less impacted by rising rates.

When we look at the same DSCR analysis we need to distinguish between bank structures that we see in the UK which typically are 100% bullet structures and those in Europe where banks have maintained a more conservative approach with c.25% of the debt on a repayment basis.

If we compare the DSCR numbers (see figure 2) we can see that a bank deal with 25% amortising Term Loan A at 3.75x EBITDA gives the same 1.4x DSCR. The resulting delta in leverage between the two structures in this example is now only 0.50x EBITDA and, based on assumed pricing, the incremental cost of this additional funding would be c.29% per annum (see figure 3).

These dynamics have been leading borrowers to look more closely at bank financings. Over the last nine months, 45%-50% of our mid-market deals across Europe have been led by banks, which is higher than the c.35% we saw in the prior two to three years. Private credit funds remain active and still play a vital role in the European financing market, but we are starting to see signs of a resurgence amongst the banks. The following are some themes that will be interesting to track.