EQUISTONE WAS AN underbidder for Nexus, a Leeds-based vehicle hire platform back in 2018, when it was acquired by a rival private equity firm in a tertiary buyout. But Will Copeland and his colleagues Andi Tomkinson and Sebastien Leusch remained keen, so when it came up for sale again in late 2022, they were able to move quickly.

“In some cases,” says Will Copeland, “if you miss out on an opportunity to invest then you may have to accept that you missed that boat – but not with this one. We knew that there was significantly more growth potential in this business. We had a good appetite to invest at the time and saw exciting growth potential despite the business being slightly below our typical investment size. We kept in touch with the business, its stakeholders and the familiar local advisors in the region.

There were plenty of reasons why Equistone remained interested in Nexus.

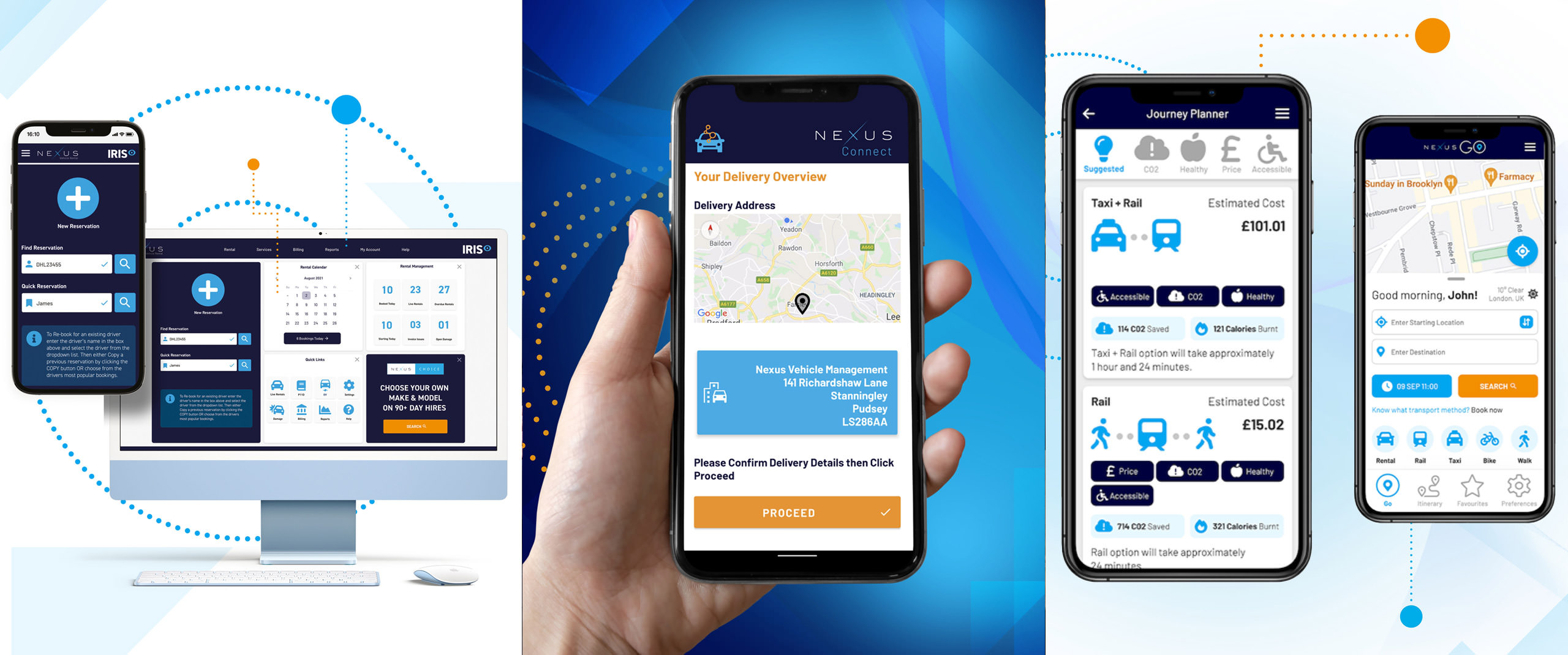

Founded in 2000, the company was a child of the original dot.com boom; and had grown into the UK’s leading B2B vehicle rental aggregator platform. Its rental management technology platform IRIS connects its customers with 235+ vehicle suppliers, giving access to more than 550,000 vehicles. It had consistently gained market share, selling direct to corporate businesses, as well as leasing companies and brokers.

It had many features of an excellent private equity investment: a capable and experienced management team; a strong and consistent financial track record (19% compound annual growth rate over eight years), comfortably surpassing the wider UK B2B rental market; it’s business model is strongly cash-generative and did not require high levels of capital expenditure; its asset-light business model provided for agility and lower risk during a recession. And it did not have any direct competitors. “It ticked a lot of boxes,“ says Will.